Reasons To Be An Actuary

Explore the compelling reasons to pursue a career in actuarial science, from high salaries and job security to the intellectually stimulating work that spans various industries. Understand the skills and mindset needed to thrive as an actuary.

Reasons To Be An Actuary: Perspective #1

If you were to ask any final year university student what the most common topic of conversation they have had with literally any other individual during their last year it will no doubt be about the future, and more specifically about what it entails. The one consistent question from my friends, my parents, my lecturers, my hairdresser and even a taxi driver has been “what are your plans once you graduate?”.

I’ll be honest, decision making is not one of my strengths. In fact, I hate making big decisions. So this question strikes a lot of fear into me. What are my plans once I graduate?

I know this seems odd for a final year Actuarial Science student to stress about since surely I would have thought about this when applying to such a specific degree course. But alas, the only comfort I have is that it appears the majority of my course mates have the same feelings towards their future. We are all in the same boat. And so, in September last year I decided to really weigh out my options of what I want to do after university and why I wanted to pursue an actuarial career.

Like many other students I began applying for actuarial graduate positions and again found myself being asked one consistent question: “Why do you want to be an Actuary?”

This time I couldn’t shrug my shoulders and make some general comment – I had to provide an answer that would relay my motivation for pursuing this career. In this article I will present the reasons to be an actuary.

Future: “a period of time that is to come” (Dictionary, 2021)

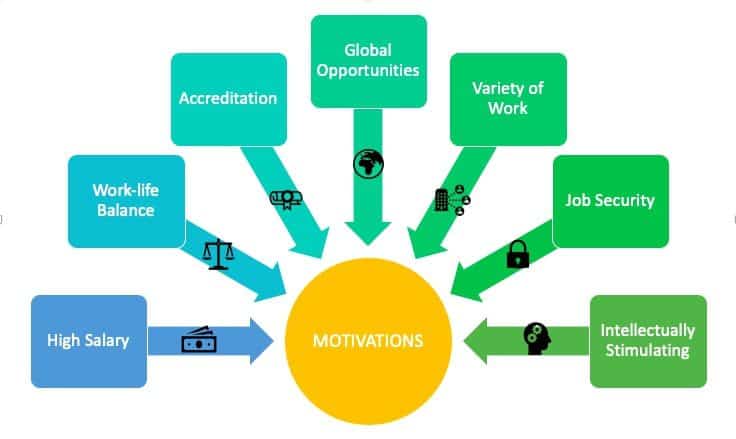

Motivation: What Are the Main Reasons to Be an Actuary?

Motivation is defined as the “enthusiasm for doing something” (Dictionary, 2021). It is what drives decision making.

High Salary

The first motivator associated with an actuarial career is the financial reward. It is no lie that actuaries are paid well. The average actuarial graduate starting salary is high compared to the UK average while chief actuaries/partners can earn an income that will land them in the top 1% of UK earners.

The expectation of high salaries is a huge motivator, or reason to be an actuary, for many. In fact, Taylor’s Principles of Scientific Management (Taylor, 1916) argues that reward is the key motivator for employees carrying out their best work.

The reason actuaries are so well paid is that they provide a fundamental role in insurance, they are expertly skilled, and they are small in number (considering demand), with the IFoA regulating and representing just over 30,000 members worldwide.

Work-Life Balance

Post qualification, actuaries also often have an enviable work-life balance that many other roles in the financial sector do not have the privilege of obtaining. This work-life balance allows actuaries to feel positive about life in and out of work and thus achieve greater job satisfaction. Unlike roles in areas such as investment banking, an actuary can expect a high salary for a work week closer to the normal 35–40 hours.

Accreditation

This work-life balance does not come easily though, as most actuaries will tell you; the first few years as an actuary are filled with steep learning curves and difficult exams. To successfully obtain this enviable work-life balance actuaries need to be self-motivating and navigate their way through complex actuarial exams.

Qualifying as an actuary in itself is also a motivator. The reason some people want to be an actuary is partly to do with the challenge. The sense of achievement will stay with the individual for life and joining a reputable global institution such as the Institute and Faculty of Actuaries (IFoA), the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS) opens many doors which will aid in achieving your career goals.

Global Opportunities

Additionally, joining the IFoA for example allows an actuary to practice both in the UK and around the world paving the way for a potentially global career.

Nevertheless, it’s not just the range of countries an actuary can practice in that is a reason to be an actuary but also the range of roles available. For example, an actuary can work in a traditional position within general insurance (P&C), life assurance, pensions, investments, reinsurance, and consultancy. However, the potential job opportunities for an actuary are also changing in line with globalisation and new technology such as Artificial Intelligence (AI) and machine learning.

A career that traditionally focused on pensions now has its fingers in data science, blockchain, Insurtechs and beyond. Actuaries of course are already aware of this. For example, the IFoA discusses the topic in their ‘Exploring the Change’ podcast and current University students in Ireland posed ideas of where actuaries may be in the future, for the Society of Actuaries in Ireland “Prize for the Creative Use of Actuarial Skills 2020”.

Variety of Work

For many actuaries, no two days in the job are the same. For instance, during my placement year in a pricing team within a general insurance firm, I could find myself using historic loss ratios to calculate profitability indicators in the morning, then present elasticity figures to stakeholders before lunch and later design a rate change in the afternoon. Pursuing a career where you get the opportunity to work on a range of projects allows an actuary to continuously learn new skills and demonstrate existing knowledge.

Job Security

By adapting to change and consistently considering the future, an actuarial career is a relatively secure one. As mentioned earlier, actuaries serve a fundamental role in insurance and have the skillset to adapt to changes in the global world of work.

Subsequently an actuarial career is one which can span many roles across many decades. The actuarial profession has survived many changes in economies, technology and the workforce over its 300-year history. As long as the actuarial profession continues to be proactive and adaptable it may yet see another 300 years.

Intellectually Stimulating

Another key reason to be an actuary is that the range of roles, countries and work an actuary can potentially explore in their career grants a highly thought provoking and interesting life. An actuary performs real-life calculations and provides real-life solutions to real-life financial problems. Not many careers allow for ongoing learning and have such a direct impact on society. The opportunity to be intellectually stimulated and rewarded is a huge motivator for an actuarial career.

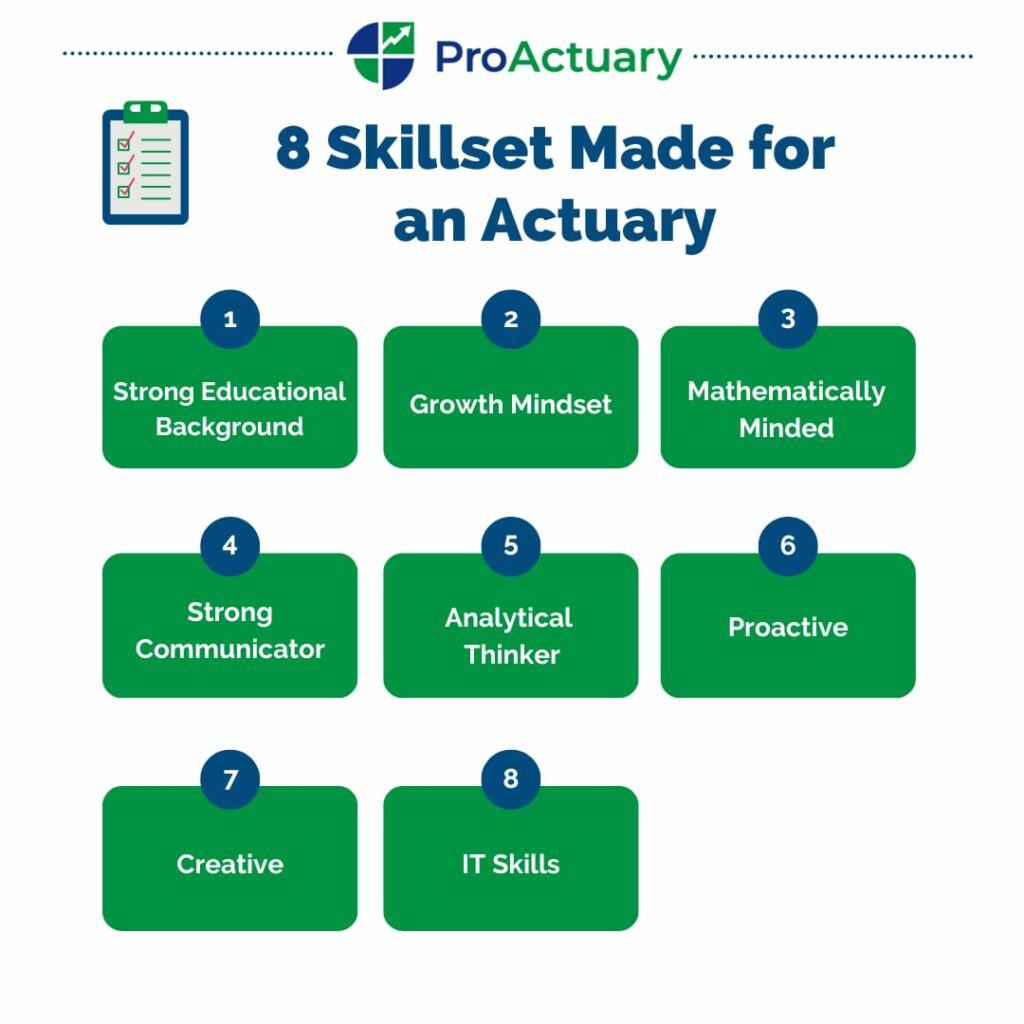

A Skillset Made for an Actuary

The above discussion highlights the motivations behind pursuing an Actuarial career but what skills and attributes does an Actuary ideally possess?

A Strong Educational Background

It’s no secret that actuarial exams are extremely challenging. Nonetheless, in order to sit said exams you can take either the traditional route, where an employer requires a minimum 2:1 degree in a mathematical subject, or the alternative option of an apprenticeship.

In the UK, both routes tend to require an A in A-level (or equivalent) Mathematics and strong results in at least 2 other A-level subjects plus excellent GSCE results (or equivalent). Having this strong educational background can be thought of as the key to opening the door marked “Actuary”.

A Growth Mindset

Alongside the strong educational background above, an actuary must learn to have a growth mindset. Many students will be used to achieving high grades in exams throughout their education yet are surprised to learn that some IFoA exams have a pass rate of under 40%. An actuarial student will need to view their failure as a learning experience rather than a setback. Developing a growth mindset is essential for progressing through the exams and qualifying as an actuary.

Likewise, a growth mindset is needed throughout an actuary’s career. The future is unpredictable and so an actuary more often than not is wrong in their predictions. By having a growth mindset these incorrect predictions are not deemed as failures but are noted and reviewed so that the margin of error can be reduced going forward.

Mathematically Minded

Not only does the ideal candidate have to have achieved the above educational requirements, but they have to enjoy working with numbers. An undergraduate degree in a mathematical subject should require hard work however should also bring the student satisfaction. From learning new mathematical proofs to building knowledge on statistical theories, maths is the foundation of which actuarial science is built upon.

A Strong Communicator

These days, communication is a must. An actuary must be a strong communicator to perform most actuarial roles well.

For example, often actuaries have to present their products and solutions to stakeholders with a range of technical knowledge. Whether it be a client, a board member, an intern, the chief actuary or a policy holder. If an actuary cannot help a stakeholder understand the impact of their work, then the work is wasted.

It is essential that an actuary is able to recognise who their audience is and adapt their communication accordingly. An actuary should also be able to listen to what a stakeholder has to say. Listening is as important a tool in communicating as speaking is.

An Analytical Thinker

By looking at a problem and wanting to know not only what is happening but why it is happening an actuary is thinking analytically. For instance, an insurance company may identify that there is a large dip in renewals from customers over the last 3 months. An actuary, as part of their skill set, should want to understand why this dip has occurred and what can be done to change the course of events. Their actions are motivated by curiosity.

“If you are curious, you will be a natural learner” (Chieh, 2020)

Proactive

Proactiveness requires an individual to take-charge of risks they see lying ahead before the impact is felt. An actuary should be proactive in their approach to developing solutions. External factors such as political/economical/technological changes will impact the role an actuary performs. By being proactive, an actuary can mitigate the negative impact these external factors may have on their work and can help companies be better prepared to face future challenges.

Creative

Contrary to the stereotypical ‘good at maths’ persona, actuaries should be creative. This doesn’t have to be creative in the sense of spending your free time painting landscapes but creative in the approach to producing solutions to real-world problems. In order to beat the competition and stay ahead of the curve, actuaries have to consider new ideas when designing solutions.

Whether it be implementing a new rating model as a pricing actuary or moving analysis from Excel to a newer software or by considering how technological advances such as IoT can be incorporated into a product solution. Creativeness will be vital in the future of financial services and insurance.

IT Skills

The future of the actuarial career lies hand in hand with technology. As mentioned under the motivations of pursuing an actuarial career, the world is changing, and it is changing faster than ever. As a result, IT skills are vital for any future actuarial successes. The ideal actuary should be highly proficient in Excel and VBA and have knowledge in a language of code (such as R or Python).

As we move towards a world with ‘big data’ everywhere, actuaries are to be expected to adapt to analysing huge amounts of information that often cannot be analysed via Excel. Likewise, they will need to consider incorporating the likes of Machine Learning and/or AI to draw conclusions and obtain solutions.

Concluding Thoughts on Reasons to be an Actuary

Ultimately there are a number of reasons to be an actuary, and these reasons may vary depending on who you ask. The above displays the motivations and the skillset behind an actuarial career. Whether it be the high-salary expectations, the opportunity to work with numbers, the work-life balance, the global reach, the IT-skills gained, the intellectual challenges, or the opportunity to communicate and produce impactful solutions, an actuarial career has many reasons to be pursued.

For me personally, it comes down to one thing; I am curious about and feel comfortable working with numbers.

Looking Ahead

So, after reading all of the above reasons to be an actuary, do you think your skillset is a good fit? Does an actuarial career fit in line with your career goals? Are you interested in what benefits it might bring you?

If so, then an actuarial career might be for you.

The Above Post Was Written by Anna Thomson

“Anna Thomson is an Actuarial Analyst at BDO UK LLP. Prior to that she was a Pricing Actuarial Intern at Liberty Insurance Ireland. Anna graduated from Queen’s University Belfast in 2021 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”

Reasons To Be An Actuary: Perspective #2

We now turn our attention to the second perspective on the same question, written by Conor McGee:

A Key Reason to be an Actuary – You Love Maths

I always knew I had a talent for mathematics. When I was 9 or 10 years old, we had a weekly times tables competition and if you beat the teacher, you won £5.

I beat the teacher that often she banned me from taking part.

I can easily say this was one of my proudest academic moments during my time in school.

Growing up in rural Ireland I never knew what an actuary was. It wasn’t until a careers class during my 6th year of school where I was flicking through a university prospectus, I stumbled upon the Actuarial Science and Risk Management degree.

I always struggled to find a career where I could pursue my passion for mathematics and reading the prospectus, I was highly intrigued and thought I’ve finally found a real-world application for my skills in mathematics.

Continuing my research, I was captivated by the idea of an actuary being able to ‘predict the future’ using statistics and the power that numbers and data really have in the world. From that day forth my mind was made up, I wanted to become an actuary.

How Hard is it to Become an Actuary?

‘Predict the future’ has been phrase that has stuck with me.

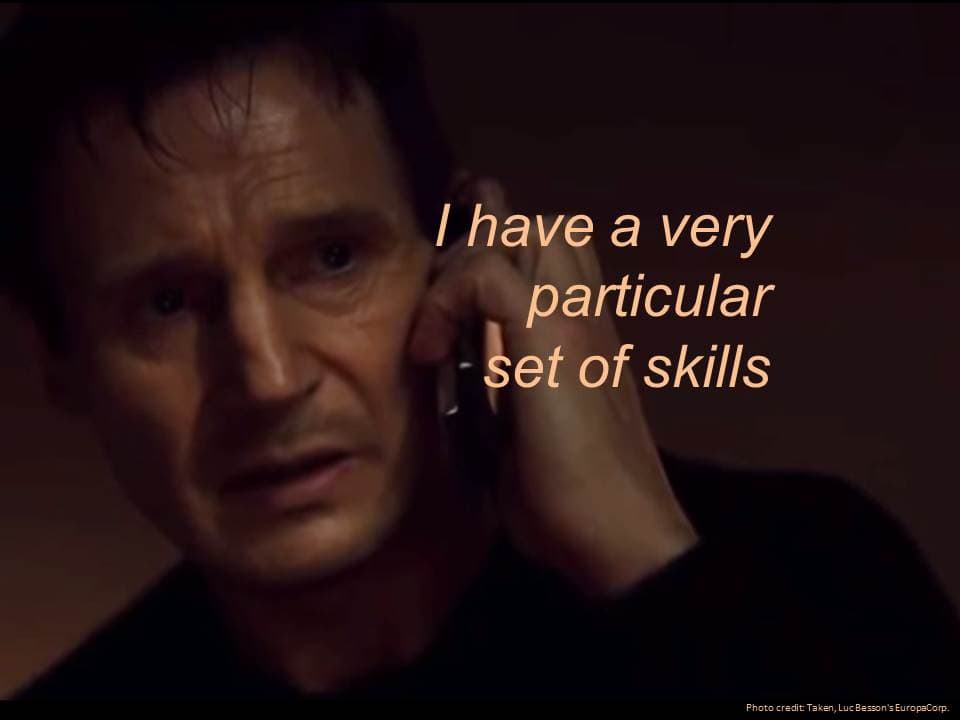

The ability to predict the future is down to the skills and knowledge that being an actuary allows you to acquire. I think of Liam Neeson’s famous quote from the movie ‘Taken’:

“But what I do have are a very particular set of skills; skills I have acquired over a very long career. Skills that make me a nightmare for people like you.”

The skillset learned as an actuary may not be as deadly but are powerful in their applications. One of the biggest reasons to be an actuary is the skills that it allows you to learn and develop.

What is the Role of an Actuary?

A career as an actuary allows you to develop your mathematical, analytical and problem-solving skills. You are also able to develop your financial and economic knowledge.

The knowledge and skills you develop as an actuary are highly sought after and allow you to climb the career ladder and to be employed in highly respected positions.

There is an existing stereotype that actuaries are just number crunchers with poor communication skills, and I can admit I held this belief before starting university.

This cannot be any further from the truth as during my placement year I had the pleasure of working with actuaries who had fantastic analytical skills but also were such great communicators.

Actuaries are definitely more than number crunchers and the community of actuaries is one of the main reasons to be an actuary. Especially now with platforms such as LinkedIn, we are able to connect with actuaries across the globe which we never would have otherwise. LinkedIn has really opened doors and has allowed me to explore the work of actuaries across the globe and has allowed me to find many interesting actuaries.

A post that really hit home was the “61 Tips for Young Actuaries’ by the former IFoA president Tan Suee Chieh. He published his 61 tips while I was on placement and a lot of them hit home, particularly those about the foundational years and I will definitely keep in mind when I start my first position as an actuary post-graduation.

One aspect I really enjoyed during my time on work placement was model building and modelling skills are now a staple of the modern actuarial profession. Models give an actuary the ability to perform tasks more efficiently and produce results of greater accuracy. Models allow an actuary to get creative and express themselves through the model.

An actuary is a storyteller through their models and, thankfully for me, actuaries tell their story through numbers and not words! Our raw data and assumptions are our outline. Our spreadsheets in Excel are our chapters and we proofread our work by checks and reasonability of results. Models allow actuaries to be creative something that cannot be said for other careers involving mathematics.

Someone who has really drawn my interest in the last few years is Warren Sharp. Although not an actuary by profession, he has previously worked for Big Four accounting firms and is currently a leader in American football analytics. Using data analytics and skills in modelling, skills very similar to those of an actuary, he is able to break down a game based massively on power and athleticism into simple numbers, to predict the outcome of NFL games and to find value in betting lines, which of course is heavily favoured towards the bookkeepers.

He was able to take the skills he has learned and apply them to something he was incredibly passionate about and make it his full-time career. He consistently beats the markets and NFL teams are now even coming to him to help them better understand the world of analytics. Is he one of the top reasons to be an actuary? Well, he’s someone that I think actuaries can take inspiration from, and hopefully someday when I’m qualified, I’ll be able to combine the skills I have learned with my passion for sports.

Many would say the actuarial profession is dying and is becoming irrelevant in the ever-evolving world of technological advancements.

I agree that the traditional actuarial role may be becoming less relevant, but new technology brings a chance for the actuarial profession to evolve and to develop the traditional lines of work or even expand into new fields of work. I would even use Warren Sharps story as an example of the endless possibilities a career as actuary can create.

My Top Reasons to Be an Actuary

Blockchain

There are many reasons to be an actuary and one exciting field is blockchain. The possibilities it brings are endless and we are currently only scratching the surface in the ways we can incorporate blockchain. Currently we see blockchain starting to be used in smart contracts and claim handling and is definitely a field where actuaries should be learning more about as it could be integral to the future of the profession.

Wearable Technologies

Another field which will become more prominent in the future is wearable technologies. I recently purchased a fitness watch and the more time I have spent using it the more I have become enamoured with the possibilities that the data it collects can bring. My watch is able to constantly track my heart rate and how active I am. Smart watches are becoming more and more developed with every iteration and some can now perform ECG’s.

In the future we could see wearable technologies and smart contracts working together, we could see the scenario where a smart watch could detect a heart attack and the watch can call for emergency services and this information is recorded through blockchain and an immediate payment of health insurance cover can be made. All these new possibilities make a career as an actuary even more enticing and is one of the many reasons to be an actuary.

Making a Difference

The biggest fear I have about my future as an actuary is the future of the professional exams.

I know the exams are essential to develop the understanding of the principles that actuaries use but will my focus on being a fellow of the IFoA be at a detriment to my ability to learn more about the future as I am learning about the principles of the past?

Will other professions being such as data scientists become more important as they are constantly learning new coding languages and more about the technological future?

Will actuaries lose their importance in predicting the future because we are stuck in the past?

While reading Tan Suee Chieh’s ‘61 Tips for Young Actuaries’, tip 52 really stood out to me “Make a difference”. This sentence made me reflect upon the actuaries’ code, in particular looking at “Competence and Care- Members must carry out work competently and with care.” Carrying your work with care is something I feel should also be interpreted as caring for those who our work as actuaries can benefit.

Actuaries over the years have been able to create many products and services that helped so many people. This is most evident in the pensions industry as our work can help retirees have no worries in their retirement as their pension plans have been appropriately funded. A lot of actuaries now work in positions within sectors where shareholder wealth is prioritised, and our code of care can be lost. Working in the pensions industry is the most rewarding work an actuary can do and someday I hope to use my skills that I will learn from being an actuary to help those in the professions who put others before themselves.

While on placement at CNP Santander, I learned how our insurance products helped so many, especially coming to the end of my placement where many of our policy holders were left unemployed due to the Covid-19 pandemic. We were able to help with payments of many essential day to day costs through our products, helping those who otherwise would have struggled without them.

I also think of a time where we found that policyholders of one of our products in Poland weren’t finding value in our product, so we increased our claim payments by 50% to help our customers. The ways our skills as actuaries can help others is massively overlooked and is something actuaries can take pride in. Throughout my time spent on placement, I gained reassurance that my work can help those that do find themselves in hardship and doesn’t just help the rich to get richer.

Be a Part of the Future

Lastly, one of the top reasons to be an actuary is that while we are entering a time where the future of the profession is uncertain and we will see more change in the coming years than there has been in the history of the profession, I think that’s what makes a career as an actuary even more attractive.

I know that, by nature, actuaries can be risk averse and are prudent in our decisions but now is a time for actuaries to really take advantage of the emerging technologies and new opportunities as society becomes more data driven. It is a chance to step outside the comfort zone of the traditional methods and fields of work and take a risk to learn new skills and apply these skills alongside our knowledge to emerging fields of work.

I hope my top reasons to be an actuary have resonated with you. As ice hockey’s greatest ever player Wayne Gretzky said, “You miss 100% of the shots you don’t take”.

Reasons to be an Actuary FAQs

The Above Perspective Was Written by Conor McGee

“Conor McGee is a Senior Actuarial Associate at PGIM Ireland. Prior to that he was an Actuarial Analyst at CNP Santander Insurance. Conor graduated from Queen’s University Belfast in 2021 with a BSc degree in Actuarial Science and Risk Management. You can connect with him on LinkedIn.”